Purchasing a home is one of the biggest decisions you will make during your lifetime, and you may be feeling anxious and a bit overwhelmed when getting started. This is normal! Here are six questions to get you focused and make the process even easier and less stressful when applying for a first-time home loan.

Unless you’re paying for your first home in cash, you’ll want to take a look at your credit report before you hit the first open house. You can find a copy of your credit report at annualcreditreport.com at no cost to you, but free access is limited to one request per year.

You will want to examine your credit reports from the three major credit bureaus (TransUnion, Experian, and Equifax) to look for mistakes and contact the bureaus if you find any errors to file a dispute.

In addition to the credit report, you will need your credit score which you can find out by going to Credit Karma or other free websites. Lenders will consult your personal credit score when deciding whether to offer you a home loan. Your credit score will also influence the terms of the loan, including the interest rate.

If your credit score is not as high as you would like it to be, there are steps you can take which can dramatically help. This includes keeping your credit card balance to below 15% of its limit, holding off on opening new lines of credit, credit cards, or loans, and always doing your best to pay your bills on time.

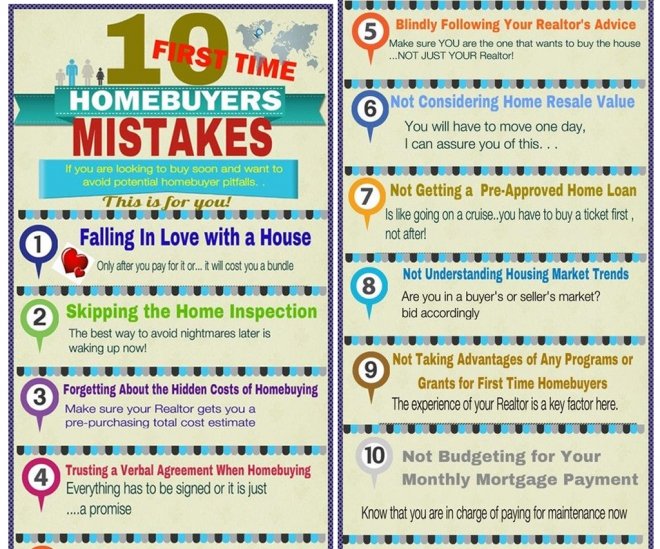

Getting pre-approved for a mortgage is a must before you start looking for a home, which means speaking to a lender. The loan officer will look over your credit, and verify your income and assets according to your W2s, tax returns, bank statements, and paychecks.

Having your pre-approval letter is almost a requirement for a realtor to show you houses or have sellers accept any offers you may make.

This letter will likely include the maximum amount they will lend you. This does not mean, however, that you should spend this amount (see point #6). In any case, a pre-approval can give you an idea of what types of houses may be in your budget before you start shopping.

How much you will need for a down payment depends on the type of mortgage you have. Loans with lower or no down payment required like FHA loans are typically popular among first-time home buyers. With an FHA loan, you only need 3.5% of the purchase price of the home as a down payment.

Here are the down payment requirements for other types of home loans:

Note that not all loan programs will be available to every borrower. For example, VA loans are reserved for active-duty military members, veterans, and, in some cases, the spouses of those who have passed away. USDA loans are only for home purchases within specific geographic areas.

As a first-time home buyer, you’re probably looking to save wherever possible. While you may think foregoing a realtor will save money, in reality the cost of hiring one is factored into the price of the home. A good Real Estate Agent, on top of helping first-time home buyers through the often complex process, can also negotiate on your behalf and help you save on the final cost of the home.

Homeownership comes with more costs than your monthly mortgage payment—you may also need to account for paying homeowner’s insurance, private mortgage insurance, closing costs, and HOA fees.

FHA loans require private mortgage insurance (PMI), no matter how much you put down. Annual premiums usually fall between 0.8% and 1% of the purchase price depending on how much the loan is and your down payment.

Conventional loans don’t require private mortgage insurance if you can put down 20% or more.

Your debt to income ratio (DTI) is your monthly income compared to your debt obligations each month. The most your DTI should be prior to factoring in a mortgage loan is 28%, while it should not exceed 50% when you include your mortgage loan. The DTI is one way to measure your ability to pay all of your bills and is often considered by lenders.

First time home buyers have a few options when it comes to loans. However, as a first time home buyer, you are probably new to home loan types and could use some guidance. Here are some of the more popular first time home buyer loans to consider.

A 30 year fixed rate mortgage offers consistency specific to the interest rate of your loan. The rate will not change throughout the 30 year term of the loan, so it allows you to better estimate and plan your monthly mortgage expenses, which can be very helpful to the first time home buyer.

A 15 year fixed rate mortgage offers the same stability as a 30 year fixed rate mortgage but just a shorter time period. If you can afford to pay more each month, a 15 year fixed rate mortgage often offers better interest rates, which can also be good for the first time home buyer.

A VA loan can be obtained without a down payment and does not require PMI (Private Mortgage Insurance), although it does require payment of a Guarantee Fee unless exempt. This is a great option for veterans who are purchasing their first home.

FHA loans give the flexibility of buying a home with a lower down payment and credit score, which is something first time home buyers can benefit from.

If you’ve been seriously shopping for a home, then you no doubt have some idea about the house and neighborhood you can afford and the money you want to put toward a down payment to keep your monthly payments manageable.

And it’s likely that during your search you’ve allowed a few compromises to creep into your thinking to make your homeownership dream come true, perhaps persuading yourself that adding 15 minutes to your commute in exchange for a bigger house wouldn’t be the end of the world.

But before you nail down your home-shopping budget, don’t forget to explore housing assistance delivered in the form of a grant. Unlike a loan, a grant is money that acts as a subsidy to the recipient assuming certain obligations outlined by the Grantor are met by the recipient. A grant can be used for a down payment, to offset your loan’s closing costs, or even buy that larger house with the extra bathroom you really want.

Sounds great, now show me the money, you say!

The good news is, first-time home buyer grants are out there. The bad news is, they’re not always easy to find.

Use the following grant information to guide and assist you as you proceed down the home buying trail.

The federal government, states, cities, private companies, and nonprofits believe that communities are strengthened through lasting and responsible homeownership. As such, they support and sponsor programs, including grants, to make homeownership more affordable.

The easiest place to start would be with your local mortgage lender. Ask if they know of any housing grants or down payment assistance programs. They may offer a lender buydown program, for example, where they may pay a portion of your interest for the first year or two of your loan. This results in benefits that are similar to a grant in that it helps you to buy your home. If they don’t know what you’re talking about, move on until you find someone who does.

Also, contact the city where you would like to live. Most cities have housing departments that run affordable/fair housing programs, often supported by federal and state funding. These same cities may have designated special assistance for areas of the city they’re seeking to rehabilitate.

For example, many cities receive Community Development Block Grants (CDBG), administered by the Department of Housing and Urban Development (HUD). In turn, cities receiving these grants disperse them through various programs and agencies to address a wide range of unique community development needs, which, of course, includes housing. HUD determines the amount of each CDBG grant by using a formula that weighs a wide range of unique community development needs.

Expand your search, as well, to include housing programs supported by your state. For instance, the California Housing Finance Agency provides a list of CalHFA-approved lenders that first-time buyers can contact to apply for a loan grant. In Texas, a similar agency, known as the Texas Department of Housing and Community Affairs (TDHCA), administers a variety of programs under such titles as the HOMEbuyer Assistance Program, Texas Bootstrap Loan Program, My First Texas Home and Texas Mortgage Credit Certificate Program.

The USDA’s Rural Housing Repair Loans and Grants program provides loans and grants to very low-income homeowners (below 50 percent of the area median income) to repair, improve, modernize, or to remove health and safety hazards in their rural dwellings. Some USDA loans can be repaid over 20 years at a fixed 1 percent interest rate. Grants of up to $7,500 may be arranged for recipients who are 62 years of age or older and can be used only to pay for repairs and improvements to remove health and safety hazards. Loan/grant combinations may be arranged for applicants who can repay part of the cost. Go to https://www.usda.gov/topics/rural/housing-assistance for more information.

Many states have their own version of the MCC, which basically provides you a dollar for dollar deduction off your federal income taxes, up to $2,000. If you don’t owe any federal taxes, however, the deduction won’t do you any good. By reducing your potential federal income tax liability, you may have more net spendable income to apply toward your monthly mortgage payment. Be sure to consult your tax advisor.

The Good Neighbor Next Door program, sponsored by the Department of Housing and Development, provides housing aid for law enforcement officers, firefighters, emergency medical technicians and pre-kindergarten through 12th-grade teachers.

Through this program, you can receive a discount of 50 percent on a home’s listed price in regions known as “revitalization areas.” Paying less than full price for a property is another form of a grant. You’re being granted a sizable price reduction that you don’t have to pay back.

The VA provides grants to U.S. servicemembers and veterans with certain permanent and total service-connected disabilities to help purchase or construct an adapted home, or modify an existing home to accommodate a disability.

Assets are another important aspect of purchasing a home. It’s all about understanding your monthly cash flow. Lenders will focus on how you spend your money, focusing on how much money you have left over every month based on your debt–to–income ratio.

Sometimes the home buying process is delayed for seemingly minor reasons—missing paperwork is one of them. If you do your research as mentioned above, you will likely find that lenders ask for proof of income and taxes. Having this documentation on hand can make the process a lot smoother and stress-free.

A good rule of thumb is to save 2 months’ worth of bank statements and paystubs and 2 years of tax returns and W-2s in an easily accessible place (for you). Make sure you update your bank statements and paystubs every 2 months and your taxes and W-2s every year.

After following the above tips, your next most important step before thinking about purchasing a home is finding a lender to pre-qualify with. It’s never too early to consult a lender.

If you need to make any corrections on your credit report or gather a little more money for the down payment, you want to make sure you aren’t pressured or running against the clock to work out any kinks. Getting pre-qualified lets you (and home sellers, for that matter) know that you are a serious buyer with access to financing, not a lookie-loo.